What is insurance?

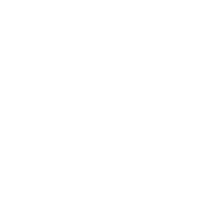

Insurance is a contract represented by a policy that offers financial protection to a person or an entity. The insurance can also reimburse against any losses, and insurance policies are used to protect one from the risk of a huge or small financial loss caused by damage to the insured property/asset.

What are the advantages of insurance companies?

Insurance policies provide financial protection to their customers against unexpected losses, such as providing financial protection to the nominee in case of an unexpected death of the insured. The insurance covers loss due to theft, fire, accident or any other natural calamities that may take place. The insurance helps maintain the living standards because many times, after a death or accident, the families could face financial troubles. Having insurance could lower the risk of families trying to change their living standards to survive and safeguard the people in terms of money. Pre-planning in the long term eliminates depending on others which can be a huge gamble as no one is legally obligated to help other families or a single adult.

The existence of insurance companies helps develop a country's economy as these insurance companies collect money that is possibly worth billions. That money is invested in various places that, over time, help grow the economy. The Insurance companies are mostly based on a huge scale, and they need thousands of people to run it efficiently. This requirement generates employment opportunities for a huge number of people, from young interns to experienced adults who fit the flexible caliber; this also helps boost the economy and provide jobs to hundreds of people. Insurance companies also promote foreign trade helping the economy in the long run as many cargo ships that import and export products are insured. Hence under the protection of insurance companies, in case of any damage, it can be covered if it is insured; this encourages the import/export industries to work more freely.

What are the disadvantages of insurance companies?

While insurance companies can cover financial losses, they do not compensate for all types of losses. They can be biased, and sometimes without much reason or logic, the companies can also try to compensate as little as possible just for the maximum profit of the company rather than honestly help their customers. This bad faith tactic causes bitterness and could cause trouble for a person who faced misfortune. Sometimes even the beneficiary may commit crimes to receive the insured amount.

Receiving financial compensation is not always that simple, as some cases can be very complicated. There could be human emotion or logic conflicting with the laws of the insurance company. There could be lengthy legal formalities that a person has to go through to receive the money; the legal requirements could financially drain a person if there is a legal dispute. Sometimes the company itself could have a long list of requirements that need to be met.